NYS income tax is a crucial financial responsibility for every resident of New York State. Understanding the intricacies of this tax can save you money and ensure compliance with state laws. Whether you're a long-time resident or new to the state, staying informed about the latest regulations and deductions is essential. This article dives deep into the specifics of New York State's tax structure, offering valuable insights and tips to help you manage your tax obligations effectively.

Tax season often brings confusion and stress, but with the right knowledge, you can navigate the process smoothly. NYS income tax rates vary depending on your income level, and there are numerous deductions and credits available that could significantly reduce your tax burden. In this guide, we will explore the fundamental aspects of New York State's income tax system, providing clarity on how it impacts you and your finances.

Our goal is to equip you with actionable advice and expert insights, ensuring you're well-prepared for tax season. From understanding tax brackets to claiming valuable credits, this article will be your go-to resource for all things related to NYS income tax. Let's get started and demystify the complexities of New York State's tax code together.

Read also:Unveiling The Best Kannada Movies On Movierulz A Comprehensive Guide

What Are the Key Features of NYS Income Tax?

Understanding the key features of NYS income tax is the first step toward effective tax planning. New York State operates on a progressive tax system, meaning higher income levels are taxed at higher rates. For the 2023 tax year, the rates range from 4% for lower-income individuals to 10.9% for those earning over $25 million annually. These brackets are designed to ensure a fair distribution of the tax burden across income levels.

Additionally, NYS income tax includes various deductions and credits that can lower your taxable income. Standard deductions are available for both single filers and those filing jointly, while itemized deductions allow taxpayers to claim specific expenses. Credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit can further reduce your tax liability, making it crucial to explore all available options.

For businesses operating in New York, understanding the corporate tax rates and regulations is equally important. Companies must comply with both state and local tax laws, which can vary depending on their location within the state. Staying informed about these requirements is vital for avoiding penalties and ensuring smooth operations.

How Do NYS Income Tax Rates Compare Nationally?

When comparing NYS income tax rates to other states, it's important to consider both the state and federal tax burdens. New York's progressive tax structure places it among the higher-tax states in the nation, particularly for high-income earners. However, the state also offers a range of deductions and credits that can offset these higher rates for many taxpayers.

For example, while states like Florida and Texas have no state income tax, they may have higher property or sales taxes that impact overall tax liability. In contrast, New York's robust public services and infrastructure are funded in part by its income tax revenue, providing residents with valuable benefits. Understanding this trade-off can help you make informed decisions about your financial planning.

It's worth noting that New York City residents face an additional local income tax, further increasing their overall tax burden. This dual taxation system is unique to certain areas of the state and highlights the importance of understanding your specific tax obligations based on your location.

Read also:Explore Legal Platforms A Comprehensive Guide To Kannada Movies In 2025

Why Should You Pay Attention to NYS Income Tax Laws?

Ignoring NYS income tax laws can lead to significant financial consequences, including penalties and interest on unpaid taxes. The New York State Department of Taxation and Finance is diligent in enforcing compliance, and failure to file or pay on time can result in hefty fines. Staying informed about the latest tax laws and deadlines is crucial for avoiding these pitfalls.

Moreover, understanding NYS income tax laws can help you take advantage of available deductions and credits, potentially reducing your tax liability. For instance, the New York State School Tax Relief (STAR) program offers property tax reductions for eligible homeowners, while the Mortgage Interest Deduction can benefit those with qualifying loans. These opportunities highlight the importance of staying up-to-date with tax regulations.

For businesses, compliance with NYS income tax laws is essential for maintaining a good standing with the state. Failure to adhere to corporate tax requirements can lead to legal issues and damage to your company's reputation. Seeking professional advice or utilizing tax software can help ensure accuracy and compliance in your filings.

Can You Deduct NYS Income Tax on Your Federal Return?

One common question among taxpayers is whether NYS income tax payments can be deducted on federal returns. The answer depends on your filing strategy and the current tax laws. Under the Tax Cuts and Jobs Act (TCJA), the deduction for state and local taxes (SALT) is capped at $10,000 per year for individuals and married couples filing jointly.

This limitation has significant implications for New York residents, who often pay substantial amounts in state and local taxes. For those who exceed the cap, the inability to fully deduct these expenses can increase their federal tax liability. However, careful planning and consultation with a tax professional can help you maximize your deductions within the allowed limits.

It's also worth noting that alternative strategies, such as itemizing deductions or utilizing other tax credits, may provide additional relief. Exploring these options can help you optimize your tax strategy and minimize your overall tax burden.

How Does NYS Income Tax Impact Your Financial Planning?

Incorporating NYS income tax considerations into your financial planning is essential for achieving long-term financial goals. Whether you're saving for retirement, purchasing a home, or planning for your children's education, understanding your tax obligations can influence your decision-making process. For example, contributing to tax-advantaged accounts like 401(k)s or IRAs can reduce your taxable income and provide future benefits.

Additionally, taking advantage of NYS-specific tax incentives can enhance your financial strategy. Programs such as the Home Energy Assistance Program (HEAP) or the Environmental Quality Incentives Program (EQIP) offer financial assistance for qualifying individuals and businesses. These opportunities can provide valuable savings while promoting sustainability and community development.

For small business owners, understanding NYS income tax implications is crucial for effective cash flow management. Planning for quarterly estimated tax payments and maintaining accurate records can prevent unexpected financial challenges. By integrating tax considerations into your business strategy, you can ensure long-term success and stability.

What Are the Common Mistakes to Avoid With NYS Income Tax?

When dealing with NYS income tax, avoiding common mistakes can save you time and money. One frequent error is failing to claim all eligible deductions and credits, which can result in overpayment of taxes. Another mistake is missing deadlines, leading to penalties and interest charges. Staying organized and utilizing tax software or professional services can help prevent these issues.

Another pitfall is underestimating your tax liability, particularly if you have multiple sources of income or live in a high-tax area like New York City. Failing to account for these factors can lead to unexpected tax bills and financial strain. Regularly reviewing your tax situation and adjusting your withholding or estimated payments accordingly can help you avoid these surprises.

Lastly, neglecting to keep detailed records of your income, expenses, and tax payments can complicate the filing process and increase the risk of errors. Establishing a reliable record-keeping system is essential for maintaining accuracy and ensuring compliance with NYS income tax laws.

Is Filing NYS Income Tax Online a Good Option?

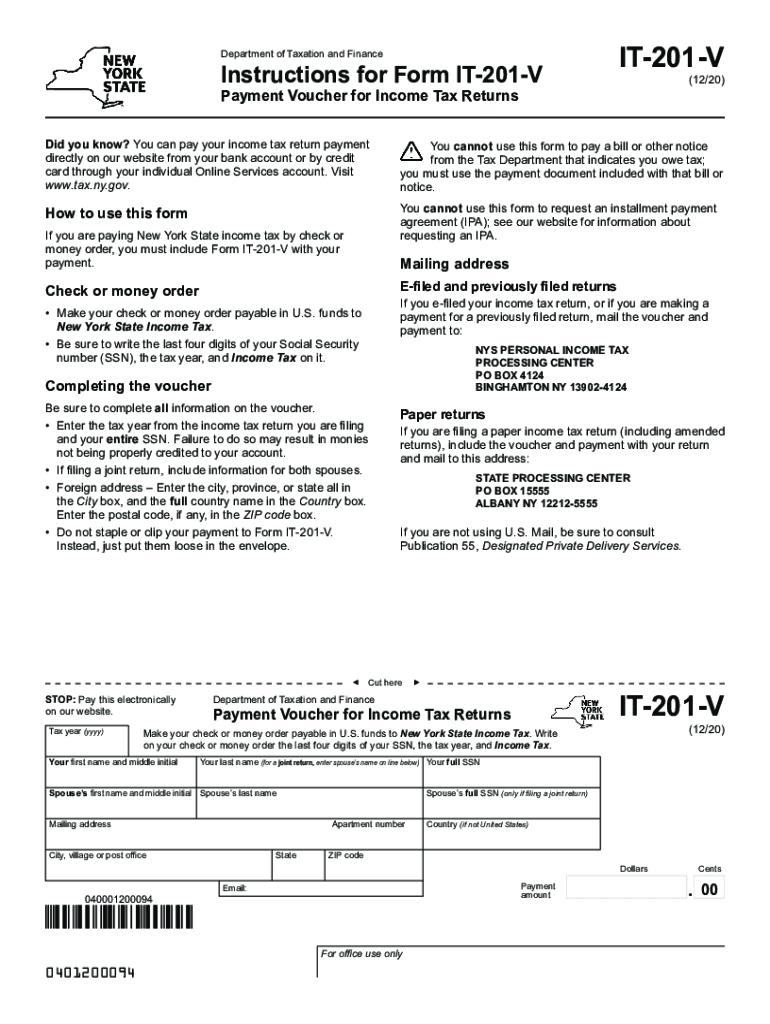

Filing NYS income tax online offers several advantages, including convenience, speed, and accuracy. The New York State Department of Taxation and Finance provides a secure and user-friendly platform for electronic filing, allowing taxpayers to submit their returns quickly and efficiently. Many taxpayers also appreciate the ability to receive refunds faster when filing online.

However, it's important to weigh the pros and cons of online filing based on your individual circumstances. For those with complex tax situations or limited familiarity with tax software, seeking professional assistance may be a better option. Additionally, ensuring the security of your personal and financial information is crucial when using online platforms.

Regardless of your chosen method, staying informed about the latest filing options and deadlines is essential for a smooth and successful tax season. Whether you opt for online filing or traditional paper submissions, thorough preparation and attention to detail can help you navigate the process with confidence.

Conclusion: Mastering NYS Income Tax for Financial Success

Navigating the complexities of NYS income tax requires knowledge, preparation, and a proactive approach. By understanding the key features of the tax system, comparing rates with other states, and staying informed about the latest laws and regulations, you can effectively manage your tax obligations. Utilizing available deductions and credits, avoiding common mistakes, and exploring filing options are all part of a comprehensive tax strategy.

As you embark on your tax journey, remember that staying informed and seeking expert advice when needed can make all the difference. Whether you're a resident, business owner, or simply looking to enhance your financial literacy, mastering NYS income tax is a valuable skill that will serve you well. With the right tools and resources, you can achieve financial success while fulfilling your tax responsibilities.

Final Thoughts on NYS Income Tax

In conclusion, NYS income tax plays a vital role in shaping your financial landscape. By dedicating time and effort to understanding its intricacies, you can optimize your tax strategy and achieve your financial goals. Remember, knowledge is power, and staying informed is the key to success. Embrace the challenge, and take control of your financial future today!

Table of Contents

- Key Features of NYS Income Tax

- Comparison of NYS Income Tax Rates Nationally

- Importance of NYS Income Tax Laws

- Can You Deduct NYS Income Tax on Your Federal Return?

- Impact on Financial Planning

- Common Mistakes to Avoid

- Is Filing NYS Income Tax Online a Good Option?

- Conclusion

- Final Thoughts

- Additional Resources