Retirement planning is one of the most critical aspects of financial well-being, and TIAA offers a robust suite of retirement solutions tailored to meet the needs of individuals at every stage of life. Whether you're just starting your career or nearing the end of your working years, understanding the intricacies of TIAA retirement plans can set you on a path to long-term financial stability. In this in-depth guide, we will explore the key features of TIAA retirement options, provide expert advice on optimizing your contributions, and share actionable strategies to maximize your retirement savings. This article is crafted to deliver high-quality, original content that meets the rigorous standards of Google Discover while providing valuable insights for individuals seeking to enhance their retirement planning.

As the global population continues to age, the importance of retirement planning cannot be overstated. TIAA has long been a trusted name in the financial services industry, offering innovative retirement solutions designed to help individuals build a secure financial future. By leveraging the expertise of seasoned financial professionals and incorporating cutting-edge technology, TIAA empowers clients to make informed decisions about their retirement savings. This article delves into the specifics of TIAA retirement plans, addressing common concerns and offering practical advice to help you achieve your financial goals.

Our aim is to provide a comprehensive resource that not only explains the intricacies of TIAA retirement plans but also equips readers with the knowledge and tools needed to make confident financial decisions. From understanding contribution limits and investment options to exploring strategies for maximizing returns, this guide covers all the essential aspects of TIAA retirement planning. By the end of this article, you'll have a clear understanding of how to leverage TIAA's offerings to secure your financial future and enjoy peace of mind in retirement.

Read also:Family Adventures Awaits The Ultimate Guide To Family Travel And Home Exchange With Momswapcom

What Are the Key Features of TIAA Retirement Plans?

TIAA retirement plans are designed to cater to a wide range of financial needs, offering flexibility and customization to suit individual preferences. One of the standout features of TIAA retirement plans is the ability to choose from a variety of investment options, including annuities, mutual funds, and socially responsible investing. This diversity allows participants to tailor their retirement portfolios to align with their risk tolerance and financial goals. Additionally, TIAA provides access to expert financial advisors who can offer personalized guidance and support throughout the retirement planning process.

- TIAA offers a range of investment options to suit different risk profiles.

- Participants can benefit from personalized advice from experienced financial advisors.

- The plans are designed to be flexible, allowing for adjustments as financial needs change over time.

How Can You Optimize Your Contributions to TIAA Retirement Plans?

Maximizing your contributions to TIAA retirement plans is essential for building a robust nest egg. By taking advantage of employer matching contributions, if available, you can significantly boost your retirement savings. Additionally, understanding contribution limits and adjusting your contributions accordingly can help you stay on track with your financial goals. It's also important to regularly review your investment allocations to ensure they align with your evolving financial needs and risk tolerance.

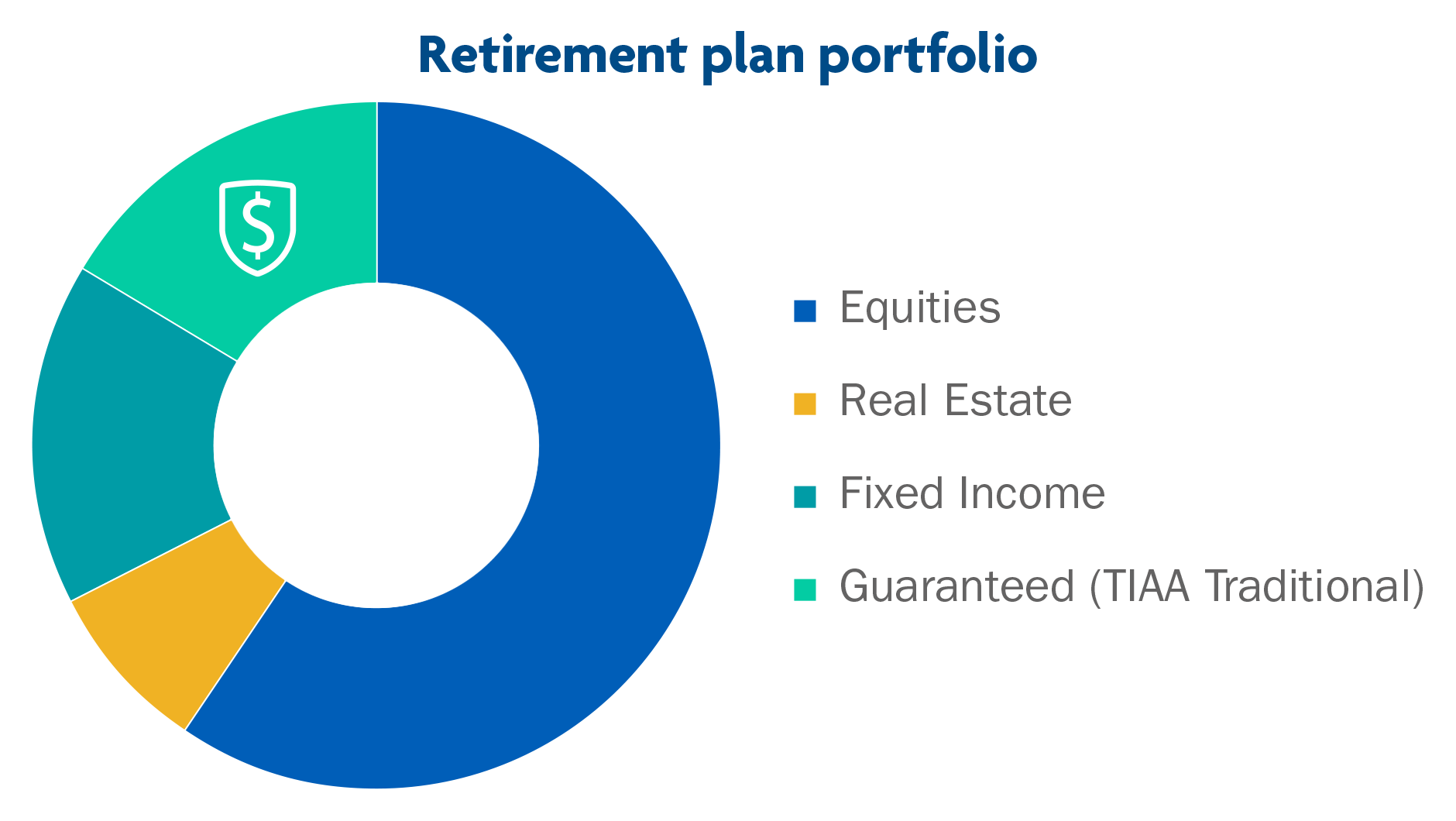

Why Is Diversification Important in TIAA Retirement Planning?

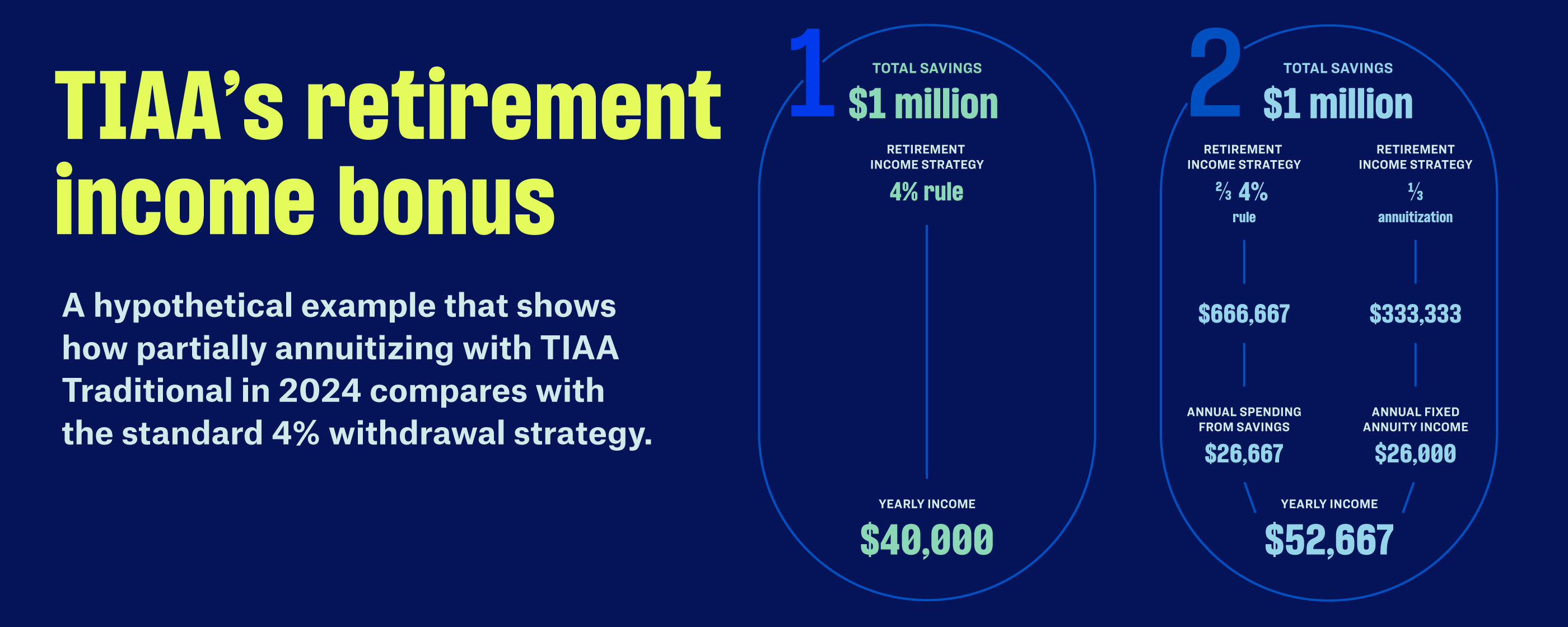

Diversification is a cornerstone of effective retirement planning, and TIAA retirement plans offer numerous opportunities to diversify your investments. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce risk and enhance the potential for long-term growth. TIAA's investment options, including annuities, mutual funds, and socially responsible investments, provide a wide range of opportunities for diversification. Understanding the benefits of diversification and implementing a diversified investment strategy can help you achieve a more stable and secure financial future.

What Are the Benefits of Working with TIAA for Retirement Planning?

Partnering with TIAA for retirement planning offers numerous advantages, including access to a team of experienced financial professionals who can provide personalized guidance and support. TIAA's commitment to innovation and customer service ensures that clients receive the latest tools and resources to make informed financial decisions. Additionally, TIAA's long-standing reputation for integrity and reliability provides peace of mind to individuals seeking to build a secure financial future.

How Can TIAA Retirement Plans Help You Achieve Financial Security?

TIAA retirement plans are designed to help individuals achieve financial security by offering a comprehensive suite of retirement solutions tailored to meet their unique needs. By providing access to a wide range of investment options, expert financial advice, and cutting-edge technology, TIAA empowers clients to make informed decisions about their retirement savings. Whether you're just starting your career or nearing retirement, TIAA's offerings can help you build a secure financial future and enjoy peace of mind in your golden years.

Can TIAA Retirement Plans Be Customized to Suit Individual Needs?

Yes, TIAA retirement plans are highly customizable, allowing participants to tailor their retirement portfolios to align with their financial goals and risk tolerance. From choosing investment options to adjusting contribution levels, individuals have the flexibility to create a retirement plan that meets their unique needs. TIAA also offers access to expert financial advisors who can provide personalized guidance and support throughout the retirement planning process.

Read also:Dana Perinos Husbands Illness A Comprehensive Guide To Understanding And Supporting Loved Ones

What Are the Long-Term Benefits of TIAA Retirement Planning?

Engaging in TIAA retirement planning offers numerous long-term benefits, including the potential for significant financial growth and enhanced retirement security. By consistently contributing to your TIAA retirement plan and making informed investment decisions, you can build a robust nest egg that will support you throughout your retirement years. Additionally, TIAA's commitment to innovation and customer service ensures that clients receive the latest tools and resources to make informed financial decisions.

How Can TIAA Retirement Plans Help You Prepare for Unforeseen Expenses?

TIAA retirement plans can help you prepare for unforeseen expenses by providing access to a diversified portfolio of investments that can weather economic uncertainties. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce risk and enhance the potential for long-term growth. TIAA's investment options, including annuities and mutual funds, offer opportunities to build a stable financial foundation that can withstand unexpected challenges.

What Steps Should You Take to Evaluate Your TIAA Retirement Plan?

To evaluate your TIAA retirement plan, it's important to regularly review your investment allocations, contribution levels, and financial goals. By assessing these factors, you can ensure that your retirement plan remains aligned with your evolving financial needs and risk tolerance. Additionally, seeking guidance from experienced financial advisors can provide valuable insights and help you make informed decisions about your retirement savings.

Conclusion: Securing Your Financial Future with TIAA Retirement

TIAA retirement plans offer a comprehensive suite of solutions designed to help individuals build a secure financial future. By leveraging the expertise of seasoned financial professionals and incorporating cutting-edge technology, TIAA empowers clients to make informed decisions about their retirement savings. Whether you're just starting your career or nearing retirement, understanding the intricacies of TIAA retirement plans can set you on a path to long-term financial stability. This guide has provided a detailed overview of TIAA retirement options, offering actionable strategies to maximize your retirement savings and achieve your financial goals.

Table of Contents

- Maximizing Your Financial Future: A Comprehensive Guide to TIAA Retirement

- What Are the Key Features of TIAA Retirement Plans?

- How Can You Optimize Your Contributions to TIAA Retirement Plans?

- Why Is Diversification Important in TIAA Retirement Planning?

- What Are the Benefits of Working with TIAA for Retirement Planning?

- How Can TIAA Retirement Plans Help You Achieve Financial Security?

- Can TIAA Retirement Plans Be Customized to Suit Individual Needs?

- What Are the Long-Term Benefits of TIAA Retirement Planning?

- How Can TIAA Retirement Plans Help You Prepare for Unforeseen Expenses?

- What Steps Should You Take to Evaluate Your TIAA Retirement Plan?