Virginia State Corporation plays a crucial role in shaping the economic landscape of the Commonwealth of Virginia. As one of the most vibrant business hubs in the United States, Virginia boasts a robust corporate structure that supports various industries. Whether you're a business owner, investor, or someone interested in corporate governance, understanding Virginia State Corporation is essential for navigating the state's business environment.

Virginia's corporate regulations are designed to ensure transparency, accountability, and growth. With its strategic location, skilled workforce, and supportive business policies, Virginia has become a preferred destination for startups, small businesses, and multinational corporations alike. This article aims to provide an in-depth exploration of Virginia State Corporation, covering everything from its formation to compliance requirements.

As you dive into this comprehensive guide, you'll discover how Virginia State Corporation operates, the benefits of incorporating in Virginia, and the key factors that contribute to its success. Whether you're looking to expand your business or simply want to learn more about corporate structures, this article is your ultimate resource.

Read also:Sharon Mae Disney The Remarkable Life And Career Of A Hollywood Legend

Table of Contents

- What is Virginia State Corporation?

- History of Virginia State Corporation

- Types of Corporations in Virginia

- Benefits of Incorporating in Virginia

- Formation Process for Virginia Corporations

- Compliance Requirements for Virginia Corporations

- Tax Considerations for Virginia Corporations

- Corporate Governance in Virginia

- Challenges and Opportunities for Virginia Corporations

- Future Trends in Virginia State Corporation

What is Virginia State Corporation?

A Virginia State Corporation refers to a legal entity formed under the laws of the Commonwealth of Virginia. This type of corporation provides limited liability protection to its shareholders, meaning that personal assets are safeguarded from business-related debts or liabilities. Additionally, corporations in Virginia enjoy perpetual existence, allowing them to continue operating regardless of changes in ownership or management.

Key Features:

- Limited Liability Protection

- Separate Legal Entity

- Perpetual Existence

- Transferable Ownership

Virginia State Corporations are governed by the Virginia Stock Corporation Act (VSCA) or the Virginia Nonstock Corporation Act (VNCA), depending on whether they issue stock or not. These acts outline the rules and regulations that corporations must adhere to, ensuring a fair and transparent business environment.

History of Virginia State Corporation

The concept of corporations in Virginia dates back to the early days of the United States. As the state's economy evolved, so did its corporate laws. The Virginia Stock Corporation Act, enacted in 1985, revolutionized the way corporations were formed and operated in the state. This act introduced modern corporate governance practices and provided businesses with greater flexibility in structuring their operations.

Key Milestones

- 1985: Enactment of the Virginia Stock Corporation Act

- 1990s: Expansion of corporate services and support systems

- 2000s: Increased focus on technology and innovation-driven businesses

Today, Virginia State Corporation continues to adapt to the changing business landscape, offering a supportive environment for entrepreneurs and established companies alike.

Types of Corporations in Virginia

Virginia recognizes several types of corporations, each tailored to meet the needs of different business structures. Understanding these types is essential for choosing the right corporate structure for your business.

Read also:Baddies For Free Unlocking The Secrets Of Selfexpression And Confidence

1. Stock Corporations

Stock corporations issue shares to shareholders and are typically profit-driven entities. They are governed by the Virginia Stock Corporation Act and are ideal for businesses seeking to raise capital through stock issuance.

2. Nonstock Corporations

Nonstock corporations do not issue shares and are often established for charitable, educational, or religious purposes. These corporations are governed by the Virginia Nonstock Corporation Act and are exempt from certain taxes if they meet specific criteria.

3. Professional Corporations

Professional corporations are formed by individuals practicing licensed professions, such as doctors, lawyers, or accountants. These corporations provide limited liability protection while maintaining professional standards.

Benefits of Incorporating in Virginia

Incorporating in Virginia offers numerous advantages, making it an attractive option for businesses of all sizes. Below are some of the key benefits:

- Strategic Location: Virginia's proximity to major cities and access to international markets make it an ideal location for business operations.

- Skilled Workforce: The state boasts a highly educated and skilled workforce, ensuring access to top talent.

- Business-Friendly Environment: Virginia's supportive policies and infrastructure foster business growth and innovation.

- Access to Capital: The state offers various funding opportunities and incentives for businesses looking to expand or start operations.

These benefits, combined with Virginia's strong legal framework, make it a premier destination for corporate formation.

Formation Process for Virginia Corporations

Forming a Virginia State Corporation involves several steps, each crucial for ensuring legal compliance and operational efficiency. Below is a step-by-step guide to the formation process:

- Choose a Name: Select a unique and distinguishable name for your corporation that complies with Virginia's naming requirements.

- Appoint a Registered Agent: Designate a registered agent to receive legal documents on behalf of your corporation.

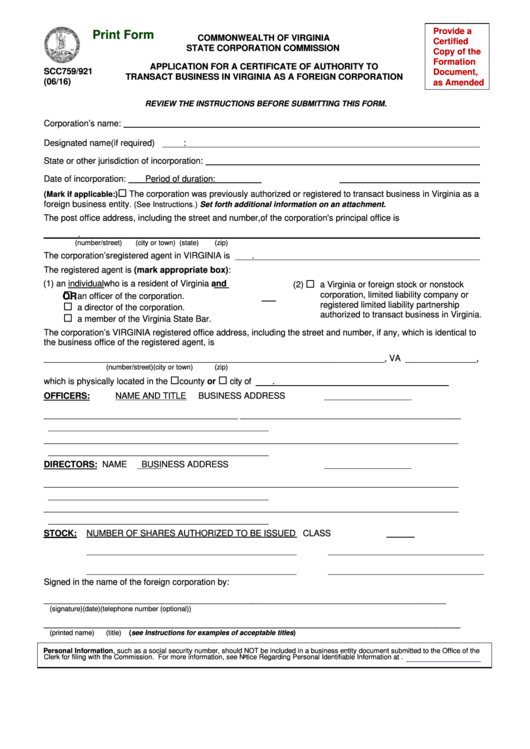

- File Articles of Incorporation: Submit the necessary paperwork to the Virginia State Corporation Commission (SCC).

- Develop Corporate Bylaws: Create a set of internal rules and procedures for governing your corporation.

- Issue Stock: If applicable, issue stock to shareholders in accordance with Virginia laws.

Following these steps ensures that your corporation is legally recognized and ready to operate in Virginia.

Compliance Requirements for Virginia Corporations

Maintaining compliance with Virginia's corporate laws is essential for the continued success of your business. Below are some key compliance requirements:

- Annual Report Filing: Submit an annual report to the Virginia State Corporation Commission by the due date.

- Corporate Record Keeping: Maintain accurate and up-to-date records of all corporate activities.

- Board Meetings: Hold regular board meetings and document all significant decisions.

- Tax Compliance: Ensure timely payment of all applicable taxes, including state and federal taxes.

Failure to comply with these requirements can result in fines, penalties, or even dissolution of the corporation. Therefore, staying informed and proactive is crucial.

Tax Considerations for Virginia Corporations

Taxes are a critical aspect of corporate operations, and understanding Virginia's tax structure is essential for effective financial planning. Below are some key tax considerations for Virginia corporations:

1. Corporate Income Tax

Virginia imposes a corporate income tax on all corporations doing business within the state. The tax rate is currently set at 6% of taxable income.

2. Franchise Tax

In addition to income tax, corporations may be subject to a franchise tax based on the value of their capital stock.

3. Sales and Use Tax

Virginia corporations must also comply with sales and use tax regulations, collecting and remitting taxes on applicable transactions.

Consulting with a tax professional or attorney is highly recommended to ensure compliance with all tax obligations.

Corporate Governance in Virginia

Corporate governance refers to the system of rules, practices, and processes by which a corporation is directed and controlled. In Virginia, corporate governance is governed by the Virginia Stock Corporation Act and the Virginia Nonstock Corporation Act.

Key Components:

- Board of Directors: Responsible for overseeing the corporation's operations and making major decisions.

- Shareholders: Owners of the corporation who have voting rights on significant matters.

- Corporate Officers: Executives responsible for day-to-day operations, such as the CEO, CFO, and COO.

Effective corporate governance ensures accountability, transparency, and alignment with the corporation's goals and values.

Challenges and Opportunities for Virginia Corporations

While Virginia State Corporation offers numerous opportunities, businesses must also navigate various challenges. Below are some key challenges and opportunities:

Challenges:

- Compliance with complex regulations

- Competition from other states and regions

- Adapting to rapidly changing market conditions

Opportunities:

- Growing technology and innovation sectors

- Access to a diverse and skilled workforce

- Supportive government policies and incentives

By addressing challenges proactively and capitalizing on opportunities, Virginia corporations can achieve sustained growth and success.

Future Trends in Virginia State Corporation

The future of Virginia State Corporation looks promising, with several trends shaping the business landscape. Below are some key trends to watch:

- Increased Focus on Sustainability: Businesses are increasingly prioritizing environmental, social, and governance (ESG) practices.

- Technological Advancements: The integration of technology in corporate operations is driving efficiency and innovation.

- Remote Work and Flexibility: The shift toward remote work is reshaping workplace dynamics and employee engagement.

Staying informed about these trends will help businesses in Virginia remain competitive and adaptable in an ever-evolving market.

Conclusion

Virginia State Corporation represents a robust and dynamic business environment that supports growth and innovation. From its strategic location and skilled workforce to its supportive policies and infrastructure, Virginia offers numerous advantages for businesses looking to thrive. By understanding the key aspects of Virginia State Corporation, including its formation process, compliance requirements, and future trends, businesses can position themselves for long-term success.

We encourage you to explore further resources and seek professional guidance to ensure your corporation complies with all legal and regulatory requirements. Share your thoughts and experiences in the comments below, and don't forget to check out our other articles for more insights into corporate governance and business development.

References:

- Virginia State Corporation Commission

- Virginia Stock Corporation Act

- Virginia Nonstock Corporation Act