Understanding New York income tax is essential for every resident and taxpayer in the state. Whether you're filing taxes for the first time or looking to optimize your tax strategy, staying informed about the state's tax laws is crucial. New York's tax system can be complex, but with the right guidance, you can ensure compliance while minimizing your tax burden.

New York income tax plays a significant role in the state's revenue collection. It funds public services, infrastructure development, and social programs that benefit all residents. This article aims to provide a thorough understanding of how New York income tax works, including its rates, deductions, credits, and filing requirements.

Whether you're an individual taxpayer, a small business owner, or a corporate entity, this guide will equip you with the knowledge needed to navigate the complexities of New York's tax system. Let's dive into the details and explore everything you need to know about New York income tax.

Read also:Jimena Herrera A Rising Star In The Entertainment Industry

Table of Contents

- Introduction to New York Income Tax

- New York State Income Tax Rates

- Filing Status and Requirements

- Deductions Available for Taxpayers

- Tax Credits in New York State

- Business Income Tax in New York

- Penalties for Late Filing and Payment

- Amending Your Tax Return

- Resources for Taxpayers

- Conclusion and Next Steps

Introduction to New York Income Tax

Overview of the Tax System

New York income tax is a progressive tax system, meaning that the tax rate increases as the taxpayer's income increases. This system ensures that higher-income individuals contribute a larger portion of their earnings to support the state's public services and infrastructure. The tax is calculated based on various factors, including filing status, income level, and deductions.

For residents, New York income tax is mandatory, and failure to comply can result in penalties and legal consequences. Understanding the tax brackets, filing deadlines, and available deductions is crucial for minimizing your tax liability and ensuring compliance.

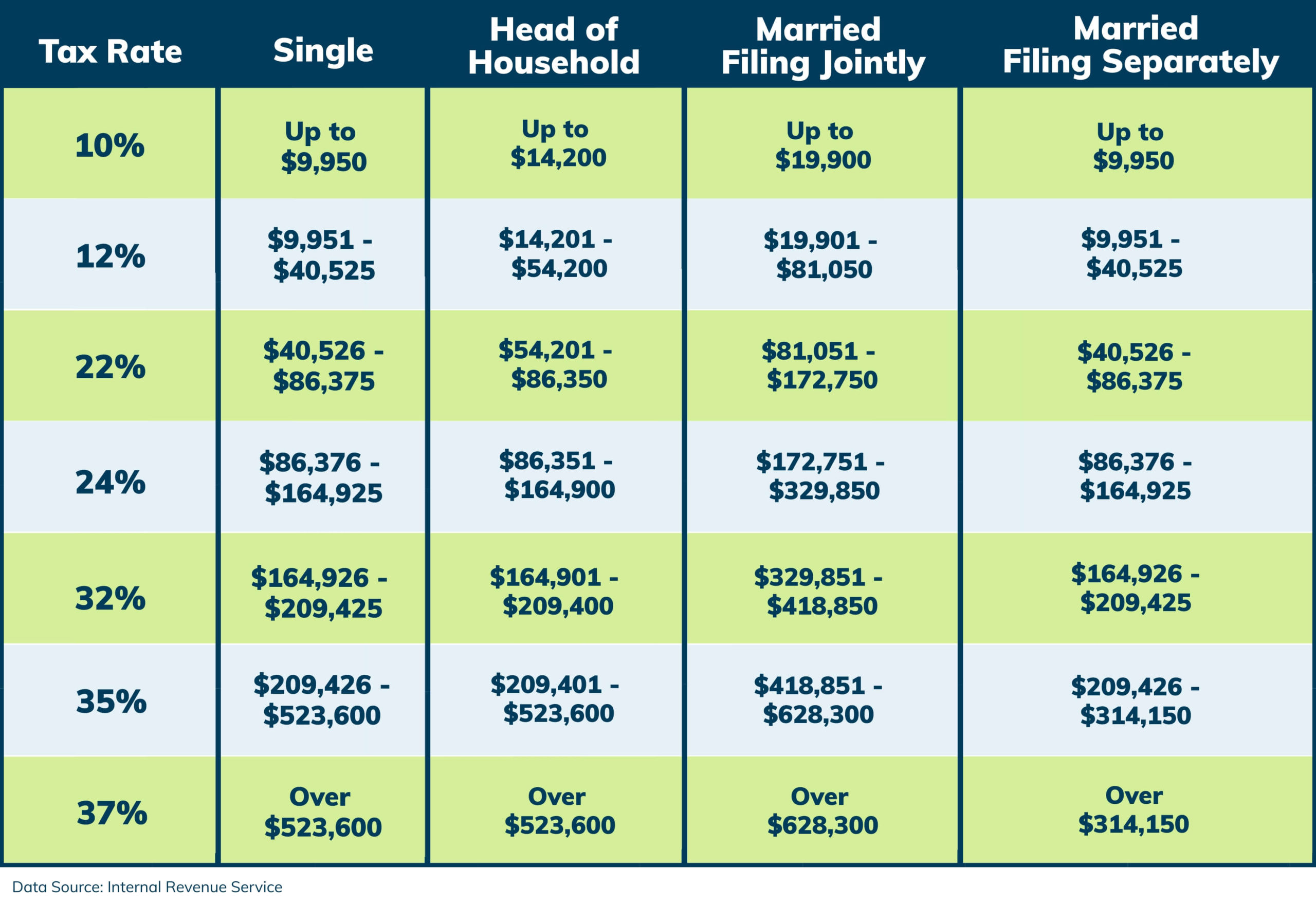

New York State Income Tax Rates

Current Tax Brackets for 2023

In 2023, New York state income tax rates range from 4% to 10.90%, depending on the taxpayer's income level. The tax brackets are structured as follows:

- 4% for income up to $8,500

- 4.5% for income between $8,501 and $11,700

- 5.25% for income between $11,701 and $23,400

- 5.97% for income between $23,401 and $215,400

- 6.23% for income between $215,401 and $1,077,550

- 8.82% for income between $1,077,551 and $5,000,000

- 10.30% for income between $5,000,001 and $25,000,000

- 10.90% for income above $25,000,000

These rates are subject to change, so it's important to stay updated on any legislative updates that may affect your tax liability.

Filing Status and Requirements

Choosing the Right Filing Status

When filing your New York income tax return, you must select the appropriate filing status. The most common filing statuses include:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

Your choice of filing status can significantly impact your tax liability, so it's important to choose the status that best reflects your financial situation. Consulting a tax professional or using tax software can help you make the right decision.

Read also:3 Guys 1 Hammer Exploring The Viral Phenomenon And Its Impact

Deductions Available for Taxpayers

Standard vs. Itemized Deductions

New York taxpayers have the option to claim either the standard deduction or itemized deductions, depending on which provides the greater benefit. The standard deduction for 2023 is $8,700 for single filers and $17,400 for married couples filing jointly.

Itemized deductions include expenses such as mortgage interest, property taxes, medical expenses, and charitable contributions. Taxpayers with significant deductible expenses may benefit more from itemizing their deductions rather than taking the standard deduction.

Tax Credits in New York State

Popular Tax Credits

New York offers several tax credits to help reduce the tax burden on eligible taxpayers. Some of the most popular credits include:

- Child Tax Credit

- Low-Income Home Energy Assistance Program (LIHEAP) Credit

- Disabled Veterans' Credit

- Elderly or Disabled Real Property Tax Credit

These credits can significantly lower your tax liability, so it's important to explore all available options and ensure you qualify for any applicable credits.

Business Income Tax in New York

Tax Obligations for Businesses

Businesses operating in New York are subject to various tax obligations, including corporate income tax, sales tax, and payroll tax. The corporate income tax rate in New York is 6.5%, with additional surcharges for businesses with higher taxable income.

Small businesses and sole proprietors may qualify for tax incentives and credits designed to encourage economic growth and job creation. Understanding these incentives can help businesses reduce their tax burden and reinvest in their operations.

Penalties for Late Filing and Payment

Avoiding Penalties

Failing to file your New York income tax return or pay your taxes on time can result in penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Additionally, a late payment penalty of 0.5% of the unpaid tax per month may apply.

To avoid penalties, it's important to file your return and pay any taxes owed by the April 15 deadline. If you're unable to meet the deadline, you can request an extension to file, but you must still pay any estimated tax owed by the original due date.

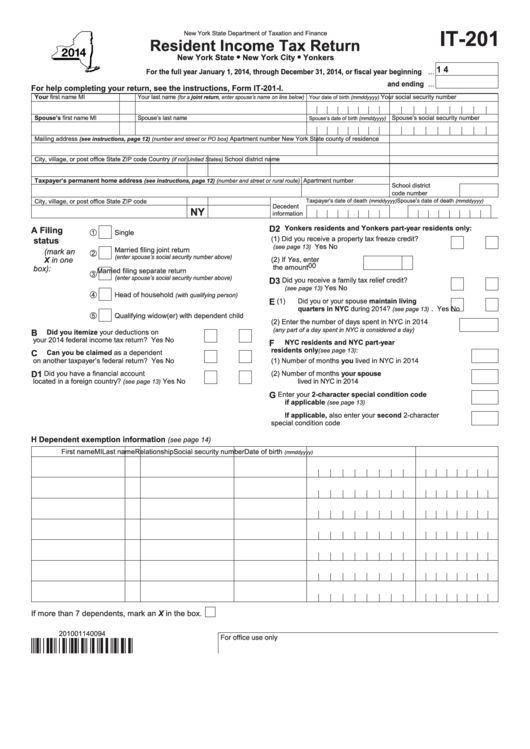

Amending Your Tax Return

Steps to Amending a Return

If you discover an error on your New York income tax return, you can amend it by filing Form IT-255. Common reasons for amending a return include:

- Incorrect filing status

- Missed deductions or credits

- Incorrect income reporting

When amending a return, it's important to include any supporting documentation and pay any additional taxes owed. The amended return should be filed as soon as possible to avoid potential penalties or interest charges.

Resources for Taxpayers

Where to Find Help

New York taxpayers have access to a variety of resources to help them navigate the tax filing process. The New York State Department of Taxation and Finance website provides comprehensive information on tax laws, rates, and filing procedures. Additionally, free tax preparation services are available through Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

For more complex tax situations, consulting a tax professional or accountant can provide personalized guidance and ensure compliance with all state and federal tax laws.

Conclusion and Next Steps

New York income tax can be complex, but with the right knowledge and resources, you can effectively manage your tax obligations. Understanding the tax brackets, deductions, and credits available can help you minimize your tax liability and maximize your financial well-being.

We encourage you to take action by reviewing your tax situation, exploring available deductions and credits, and ensuring timely filing and payment of your taxes. Don't hesitate to seek professional advice if needed. Share this article with others who may benefit from the information, and explore more articles on our site for additional insights into personal finance and tax planning.