When it comes to taxation in the United States, each state has its own rules and regulations, and the FTB State of California plays a crucial role in managing these aspects for Californians. The Franchise Tax Board (FTB) is the governing body responsible for overseeing tax-related matters in California. Whether you're an individual taxpayer or a business entity, understanding the FTB's functions and requirements is essential for compliance and financial planning.

This article delves into the intricacies of the FTB State of California, providing you with valuable insights, practical tips, and actionable information. From its primary responsibilities to the latest updates in tax laws, we will cover everything you need to know to stay informed and prepared.

As tax regulations evolve, staying updated is not just beneficial—it's necessary. By the end of this guide, you'll have a clear understanding of the FTB's role, how it impacts your finances, and steps you can take to ensure compliance. Let’s dive in!

Read also:Michael Voltaggio Net Worth A Comprehensive Look At The Renowned Chefs Financial Empire

Table of Contents

- What is FTB?

- FTB State of California Overview

- Key Functions of FTB

- Tax Filing with FTB

- Important Tax Deadlines

- Penalties for Non-Compliance

- FTB Resources for Taxpayers

- Frequently Asked Questions About FTB

- Recent Updates in FTB Policies

- Conclusion

What is FTB?

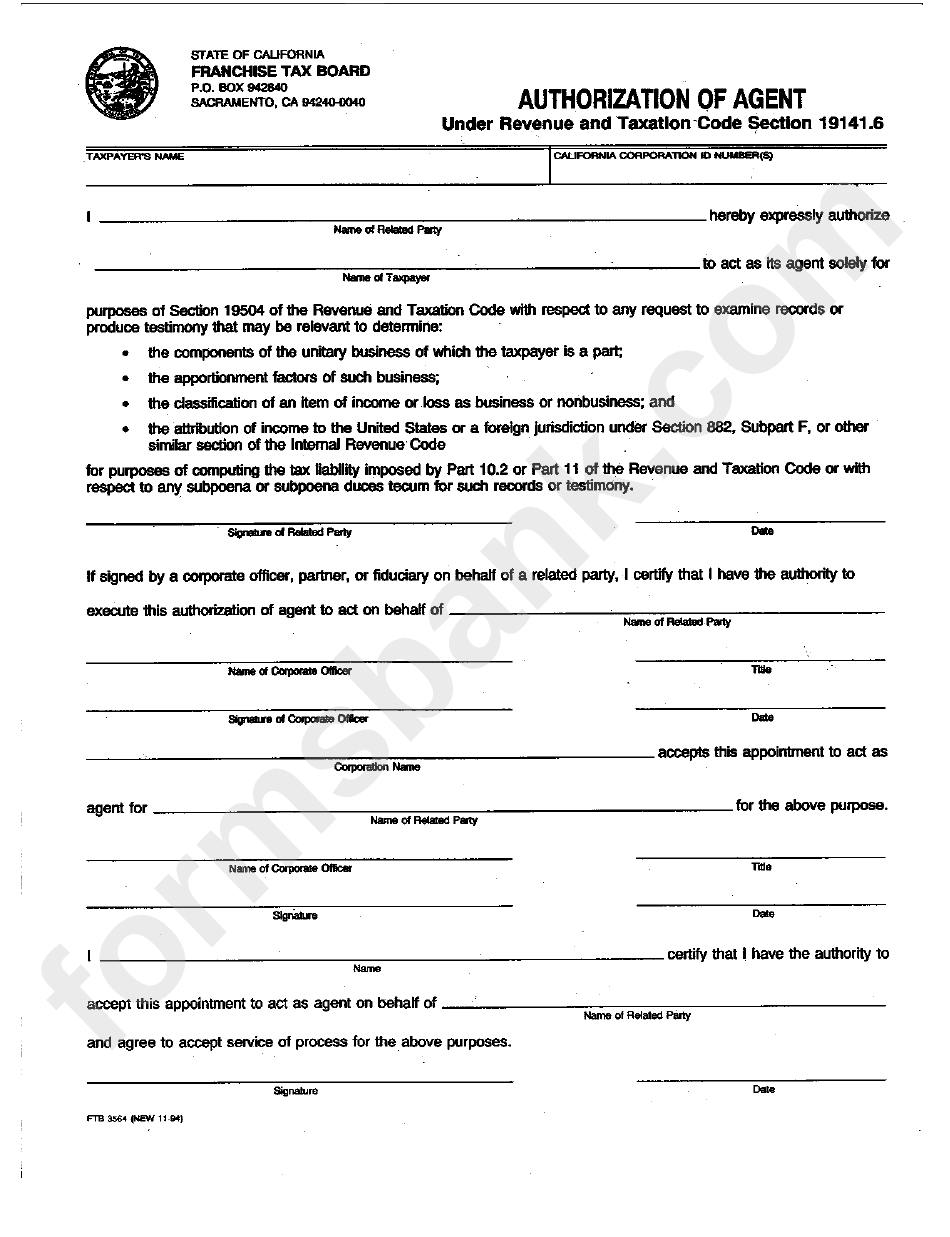

The Franchise Tax Board (FTB) is the state agency responsible for administering California’s tax laws. Established in 1976, the FTB ensures that all individuals and businesses within California adhere to the state's tax requirements. This includes the collection of income taxes, franchise taxes, and other related fees.

Role of FTB

The primary role of the FTB is to oversee the administration of California’s tax system. This involves:

- Processing tax returns

- Enforcing tax laws

- Providing taxpayer assistance

- Ensuring accurate reporting of taxable income

Through its various programs and initiatives, the FTB aims to maintain a fair and efficient tax system for all Californians.

FTB State of California Overview

The FTB State of California operates under the California Revenue and Taxation Code. Its mission is to ensure that all taxpayers fulfill their obligations while also providing support and resources to help them navigate the tax process.

History of FTB

The history of the FTB dates back to the early days of California's statehood. Over the years, the agency has evolved to meet the changing needs of taxpayers and the state’s economy. Today, the FTB is a leader in tax administration, leveraging technology and innovative strategies to enhance its services.

Key Functions of FTB

The FTB performs several critical functions that are vital to California's tax system. These include:

Read also:Misty Raney A Comprehensive Look At The Life And Achievements Of An Iconic Figure

- Income Tax Collection: The FTB is responsible for collecting personal and corporate income taxes.

- Franchise Tax: Businesses operating in California must pay a franchise tax, which the FTB administers.

- Taxpayer Assistance: The FTB offers various resources to assist taxpayers in understanding and complying with tax laws.

- Enforcement: The agency enforces tax laws to ensure compliance and prevent fraud.

These functions are designed to create a balanced and equitable tax system that benefits both individuals and businesses.

Tax Filing with FTB

Filing taxes with the FTB State of California is a straightforward process, but it requires attention to detail to ensure accuracy. Here’s what you need to know:

Steps to File Taxes

To file your taxes with the FTB:

- Gather all necessary documents, such as W-2s, 1099s, and other income statements.

- Use the FTB’s online filing system or complete a paper return.

- Double-check your calculations and information before submitting.

By following these steps, you can ensure a smooth and error-free filing process.

Important Tax Deadlines

Knowing the tax deadlines is crucial for avoiding penalties and ensuring timely compliance. Here are some key dates to remember:

Annual Deadlines

- April 15: Deadline for filing personal income tax returns.

- March 15: Deadline for filing corporate income tax returns.

- January 10: Deadline for employers to issue W-2 forms to employees.

Staying aware of these deadlines can help you plan effectively and avoid last-minute rushes.

Penalties for Non-Compliance

Failing to comply with FTB regulations can result in significant penalties. These penalties may include:

- Failure-to-file penalties

- Failure-to-pay penalties

- Interest on unpaid taxes

It’s essential to adhere to the FTB’s guidelines to avoid these costly consequences.

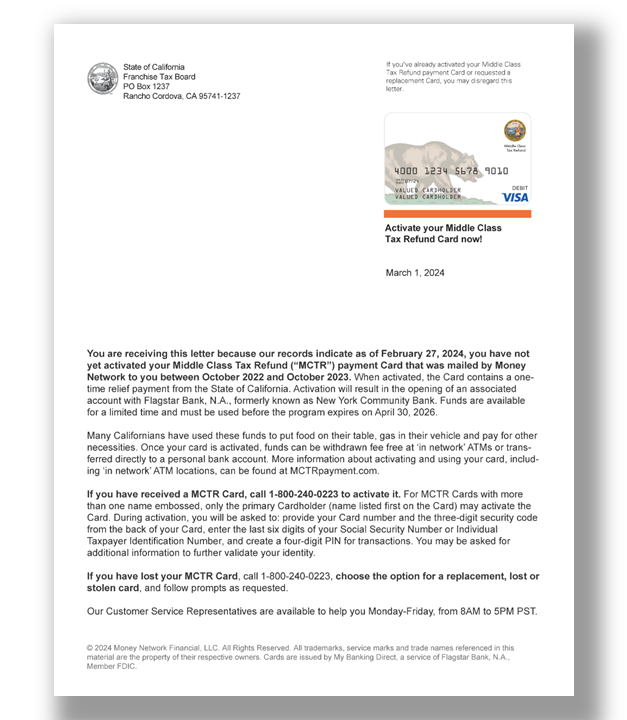

FTB Resources for Taxpayers

The FTB offers a wealth of resources to assist taxpayers. These resources include:

- Online Tools: The FTB’s website provides calculators, forms, and guides to help with tax preparation.

- Customer Service: Taxpayers can reach out to the FTB via phone, email, or in-person for assistance.

- Publications: The FTB publishes informative booklets and guides on various tax topics.

Utilizing these resources can make the tax process easier and more manageable.

Frequently Asked Questions About FTB

Here are some common questions taxpayers have about the FTB State of California:

What is the FTB's contact information?

The FTB can be reached at:

- Phone: (800) 852-5711

- Website: www.ftb.ca.gov

How do I check my refund status?

You can check your refund status by visiting the FTB’s website and entering your Social Security Number or ITIN and the exact amount of your refund.

Recent Updates in FTB Policies

The FTB State of California regularly updates its policies to reflect changes in tax laws and economic conditions. Recent updates include:

- New guidelines for remote workers

- Expanded eligibility for tax credits

- Enhanced online security measures

Staying informed about these updates can help you take full advantage of available benefits and avoid potential pitfalls.

Conclusion

In conclusion, the FTB State of California plays a vital role in administering the state’s tax system. By understanding its functions, deadlines, and resources, you can ensure compliance and make informed financial decisions. Remember to:

- File your taxes on time

- Utilize available resources

- Stay updated on policy changes

We encourage you to share this article with others who may find it helpful and explore more content on our website for further insights. Your feedback and questions are always welcome!