Planning for retirement can feel overwhelming, but understanding your options is the first step to securing a stable future. The State Employees Retirement System (SERS) Ohio is one such option that provides public employees in Ohio with comprehensive retirement benefits. Whether you're a teacher, healthcare worker, or any other state employee, SERS Ohio plays a crucial role in ensuring financial stability during your golden years. This article delves into the intricacies of SERS Ohio, offering insights into its benefits, eligibility criteria, and how it can impact your retirement planning. By the end of this guide, you’ll have a clearer understanding of how SERS Ohio can help you achieve your financial goals.

As individuals navigate their career paths, planning for retirement becomes an essential consideration. SERS Ohio stands out as a reliable partner for those employed by the state of Ohio. With its robust framework, it offers not just monetary benefits but also peace of mind for employees nearing retirement age. Understanding the system’s nuances, including contribution rates, pension calculations, and additional perks, empowers you to make informed decisions about your financial future.

This guide aims to demystify the complexities of SERS Ohio by breaking down key aspects in an easy-to-understand format. From eligibility requirements to maximizing your benefits, we’ll cover everything you need to know to leverage this system effectively. Let’s dive in and explore how SERS Ohio can be tailored to meet your unique needs and aspirations.

Read also:Unveiling The Best Kannada Movies On Movierulz A Comprehensive Guide

What Is SERS Ohio?

SERS Ohio, or the State Employees Retirement System of Ohio, is a public pension plan designed to provide retirement benefits to employees of the state of Ohio. Established to support state workers, SERS Ohio ensures they receive consistent income after retirement. This system is governed by a board of trustees and operates under strict regulations to safeguard the interests of its members.

One of the standout features of SERS Ohio is its ability to adapt to the evolving needs of its members. Over the years, it has introduced various tiers and options to cater to different employment scenarios, ensuring that all eligible employees benefit from its offerings. Understanding the structure and purpose of SERS Ohio is critical for anyone looking to secure their financial future through this program.

How Does SERS Ohio Work?

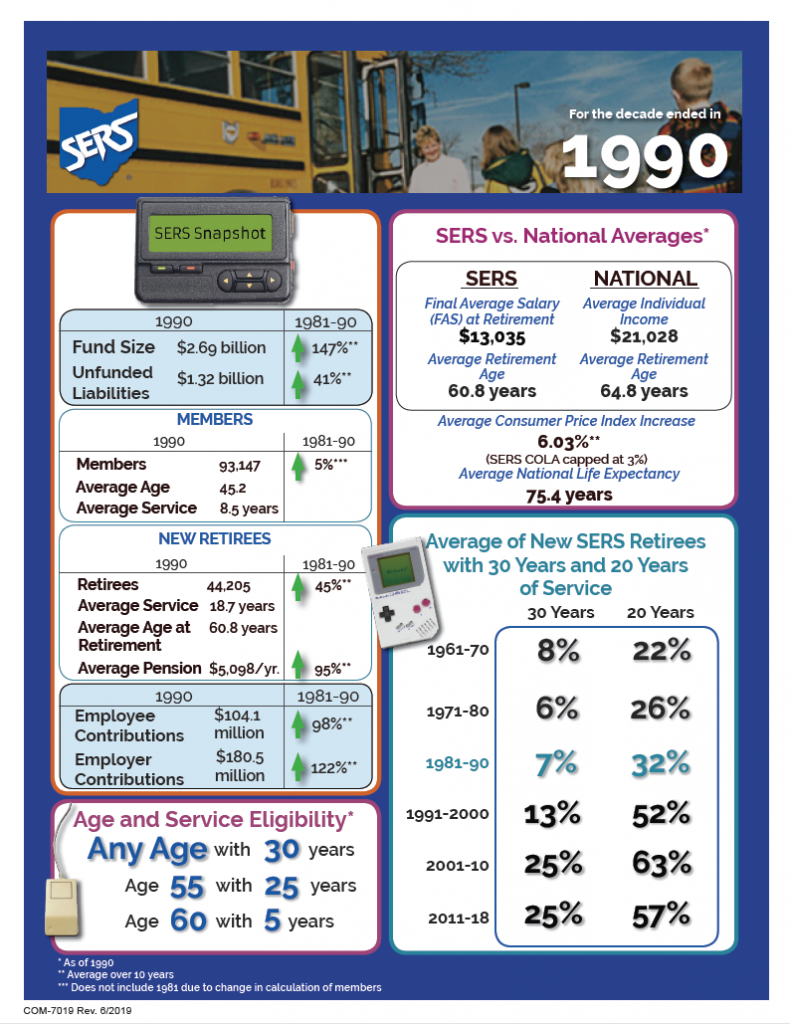

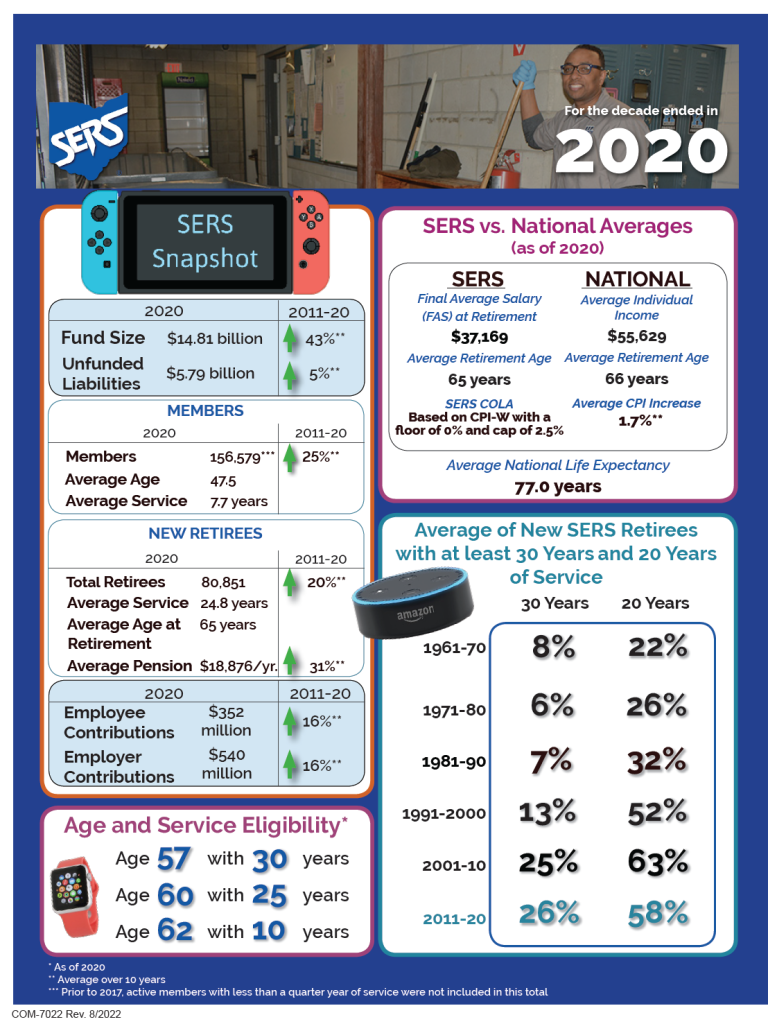

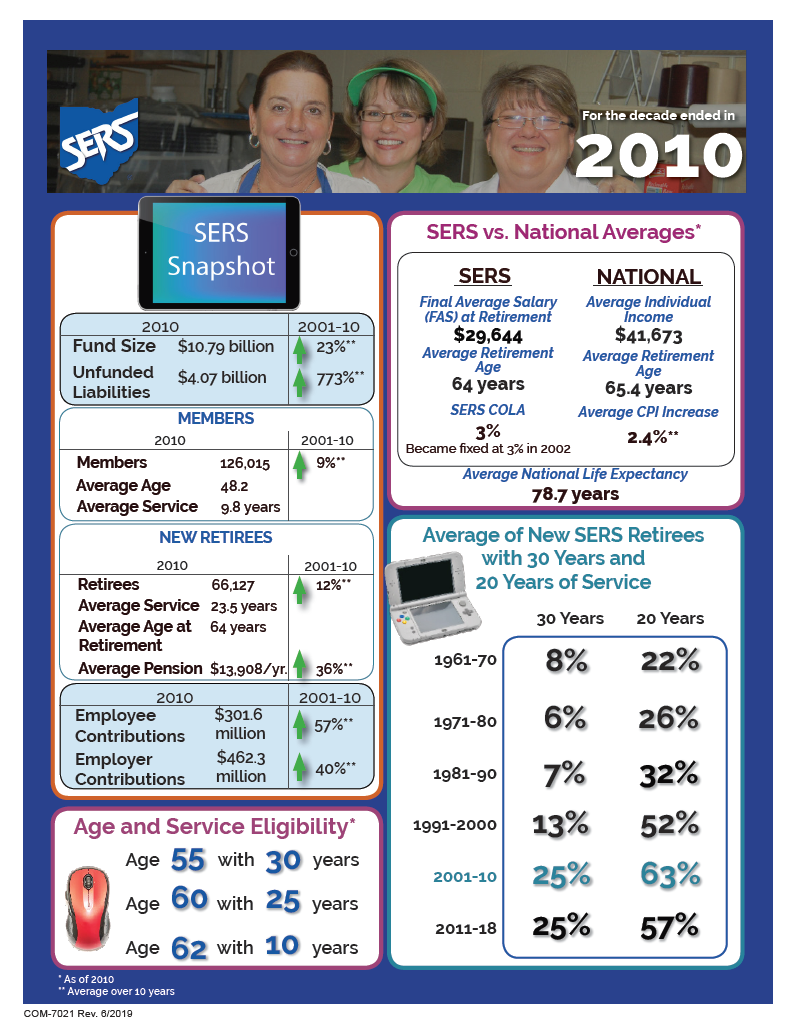

At its core, SERS Ohio functions by requiring employees to contribute a portion of their salary towards their retirement fund. These contributions, combined with employer contributions and investment returns, form the basis of the pension benefits provided upon retirement. The system calculates retirement benefits based on factors like years of service, final average salary, and the specific tier under which the employee falls.

For example, if you’ve been contributing to SERS Ohio for 30 years, your retirement benefits will reflect the longevity of your service. Additionally, the system offers survivor benefits, disability options, and deferred compensation plans, making it a comprehensive solution for financial security in retirement.

Why Should You Choose SERS Ohio for Retirement?

Choosing SERS Ohio for retirement planning offers numerous advantages. Firstly, it provides a predictable income stream during retirement, which is invaluable in an era of economic uncertainty. Secondly, the system’s long-standing reputation for reliability and transparency adds a layer of trust, ensuring that members’ contributions are managed responsibly.

Moreover, SERS Ohio offers flexibility through its tiered system, allowing members to select options that align with their career trajectories and financial goals. Whether you’re a young professional just starting out or a seasoned employee nearing retirement, SERS Ohio has something to offer everyone.

Read also:Unveiling The Ultimate Movie Experience Your Guide To Desiremoviesemail Entertainment

Who Is Eligible for SERS Ohio?

Eligibility for SERS Ohio is primarily determined by your employment status with the state of Ohio. Generally, any employee working for a state agency or institution qualifies for enrollment. However, specific criteria may vary depending on your job role and the nature of your employment.

It’s important to note that part-time employees and those in temporary positions may also qualify under certain conditions. For instance, if you work part-time but accumulate sufficient hours over a set period, you could become eligible for SERS Ohio benefits. Understanding these nuances is crucial for ensuring you don’t miss out on potential retirement benefits.

What Are the Key Benefits of SERS Ohio?

SERS Ohio offers a range of benefits that make it an attractive option for retirement planning. One of the primary advantages is the guaranteed pension benefit, which provides a steady income stream after retirement. This benefit is calculated based on your years of service and final average salary, ensuring that your contributions translate into meaningful financial support.

In addition to the pension, SERS Ohio provides survivor benefits, which offer financial protection for your loved ones in the event of your passing. The system also includes disability benefits, ensuring that you’re covered in case of unforeseen circumstances. These comprehensive offerings make SERS Ohio a robust choice for securing your financial future.

Can You Transfer Benefits from Other Plans to SERS Ohio?

A common question among employees is whether they can transfer benefits from other retirement plans to SERS Ohio. The answer is yes, under certain conditions. If you’ve previously participated in another public pension plan, you may be able to consolidate your benefits into SERS Ohio, streamlining your retirement planning process.

However, the specifics of transferring benefits depend on factors such as the type of plan you’re transferring from and the terms of your current employment. Consulting with a financial advisor or SERS Ohio representative can help clarify these details and ensure a smooth transition.

How Much Do You Need to Contribute to SERS Ohio?

Contribution rates for SERS Ohio vary depending on your employment tier and classification. As of the latest updates, employees typically contribute around 10% of their salary to the system. Employers also contribute a matching amount, enhancing the overall value of your retirement fund.

These contributions are automatically deducted from your paycheck, making the process seamless and hassle-free. It’s important to note that the longer you contribute, the higher your potential retirement benefits. Therefore, staying enrolled in SERS Ohio throughout your career can significantly boost your financial security in retirement.

What Happens If You Leave Your Job Before Retirement?

A frequent concern among employees is what happens to their SERS Ohio benefits if they leave their job before reaching retirement age. Fortunately, the system offers several options to address this scenario. You can choose to leave your contributions in the system and access them once you reach retirement age, or you may opt for a lump-sum payout.

Another alternative is rolling over your contributions into another retirement account, such as an IRA. This flexibility ensures that your hard-earned contributions aren’t lost, even if your career path changes unexpectedly.

Is SERS Ohio the Right Choice for Everyone?

While SERS Ohio offers many advantages, it’s essential to evaluate whether it aligns with your personal financial goals and circumstances. Factors such as your career length, expected retirement age, and other retirement savings plans should all be considered. For instance, if you have additional retirement accounts or expect substantial income from other sources, SERS Ohio might serve as a supplementary rather than primary source of retirement income.

Ultimately, the decision to enroll in SERS Ohio should be based on a thorough assessment of your financial situation and future aspirations. Consulting with a financial advisor can provide personalized guidance tailored to your unique needs.

How Can You Maximize Your SERS Ohio Benefits?

Maximizing your SERS Ohio benefits involves strategic planning and informed decision-making. One of the most effective ways to enhance your benefits is by staying enrolled in the system for as long as possible. The longer you contribute, the higher your potential retirement income.

Additionally, taking advantage of optional programs like deferred compensation can supplement your SERS Ohio benefits. These programs allow you to save additional funds on a tax-advantaged basis, providing an extra layer of financial security in retirement.

What Should You Know About SERS Ohio’s Investment Strategy?

SERS Ohio employs a diversified investment strategy to manage its funds and ensure long-term growth. This approach involves allocating assets across various sectors and asset classes to mitigate risk while pursuing optimal returns. Members benefit from the system’s expertise in managing investments, allowing them to focus on their careers without worrying about the intricacies of fund management.

It’s worth noting that SERS Ohio regularly reviews and adjusts its investment strategy to adapt to changing market conditions. This proactive approach helps safeguard the system’s financial health and the benefits of its members.

How Can You Stay Updated on SERS Ohio Changes?

Keeping abreast of changes to SERS Ohio is vital for maximizing your benefits. The system frequently updates its policies and procedures, so staying informed ensures you’re aware of any adjustments that could impact your retirement planning. Subscribing to SERS Ohio newsletters, attending informational sessions, and regularly checking their official website are excellent ways to stay updated.

Engaging with SERS Ohio representatives and attending workshops can also provide valuable insights into the system’s workings and help you make the most of your benefits.

Conclusion: Embracing SERS Ohio for a Secure Future

SERS Ohio represents a cornerstone of retirement planning for state employees in Ohio. By understanding its benefits, eligibility requirements, and strategies for maximizing your contributions, you can lay the foundation for a financially secure retirement. Whether you’re just starting your career or nearing retirement age, SERS Ohio offers a reliable and comprehensive solution for achieving your financial goals.

As you navigate the complexities of retirement planning, remember that SERS Ohio is designed to support you every step of the way. By leveraging its offerings and staying informed about updates, you can ensure a stable and fulfilling retirement. Embrace the opportunities provided by SERS Ohio and take control of your financial future today.

Table of Contents

- What Is SERS Ohio?

- How Does SERS Ohio Work?

- Why Should You Choose SERS Ohio for Retirement?

- Who Is Eligible for SERS Ohio?

- What Are the Key Benefits of SERS Ohio?

- Can You Transfer Benefits from Other Plans to SERS Ohio?

- How Much Do You Need to Contribute to SERS Ohio?

- What Happens If You Leave Your Job Before Retirement?

- Is SERS Ohio the Right Choice for Everyone?

- How Can You Maximize Your SERS Ohio Benefits?