FTB California, or the Franchise Tax Board of California, is a state agency responsible for administering California's income tax laws and certain other taxes and fees. This organization plays a crucial role in ensuring that taxpayers comply with state regulations while also providing resources to help individuals and businesses understand their obligations. Whether you're a resident, a business owner, or someone looking to learn more about state tax responsibilities, this guide will walk you through everything you need to know about FTB California. From understanding your tax obligations to exploring available benefits and resources, we'll cover it all in detail.

California's FTB is one of the most important agencies for residents and businesses, ensuring that the state's financial systems run smoothly. The board handles everything from individual income taxes to corporate tax filings, making it an essential entity for anyone living or operating in the state. Understanding how this agency operates can help taxpayers avoid penalties and ensure compliance with state regulations. This article aims to provide a clear, concise overview of FTB California's role, responsibilities, and resources.

As you dive deeper into this guide, you'll discover valuable information on how to interact with FTB California effectively. Whether you're filing taxes, seeking assistance with tax disputes, or looking for resources to help you better understand your obligations, this article will serve as a comprehensive resource. With a focus on providing actionable insights and practical advice, we'll ensure you're well-equipped to navigate the complexities of California's tax landscape.

Read also:Unveiling The Truth Julia Montesrsquo Baby Journey Milestones And Insights

What Is the FTB California?

The FTB California is the state's primary tax administration agency, responsible for enforcing California's tax laws and ensuring compliance. Established to streamline tax processes and provide taxpayer support, the FTB plays a vital role in maintaining the financial health of the state. It administers a variety of taxes, including personal income tax, corporate taxes, and other specialized levies. Understanding the scope of its responsibilities is key to staying informed about your tax obligations.

Why Is FTB California Important for Taxpayers?

Taxpayers in California rely on the FTB to ensure that their filings are accurate and compliant with state regulations. The agency provides numerous resources, such as online filing tools, tax calculators, and detailed guides, to help individuals and businesses navigate the complexities of tax laws. Additionally, the FTB offers assistance with resolving disputes, answering questions, and addressing concerns about tax liabilities. By understanding the importance of the FTB, taxpayers can better prepare for their annual filings and avoid potential penalties.

How Does FTB California Support Businesses?

For businesses operating in California, the FTB offers specialized support and resources to ensure compliance with state tax laws. This includes guidance on corporate tax filings, payroll taxes, and other business-related obligations. The agency also provides tools and services to simplify the tax process, such as electronic filing options and detailed compliance guides. By leveraging these resources, businesses can focus on growth while ensuring they meet all necessary tax requirements.

What Are the Key Responsibilities of FTB California?

The FTB California has several core responsibilities, including administering income taxes, enforcing tax laws, and providing taxpayer support. These responsibilities are designed to ensure that the state's financial systems remain stable and that all taxpayers fulfill their obligations. Some of the key areas of focus for the FTB include:

- Processing individual and corporate tax returns

- Enforcing tax compliance through audits and investigations

- Providing resources and support for taxpayers

- Collecting unpaid taxes and resolving disputes

What Resources Does FTB California Offer?

To assist taxpayers, the FTB California provides a wide range of resources, including online tools, guides, and customer service options. These resources are designed to make the tax process easier and more accessible for individuals and businesses alike. Some of the most useful resources include:

- Online filing portals for individual and corporate taxes

- Tax calculators to help estimate liabilities

- Comprehensive guides and FAQs on tax laws and regulations

- Customer service options for resolving disputes and answering questions

How Can I File Taxes with FTB California?

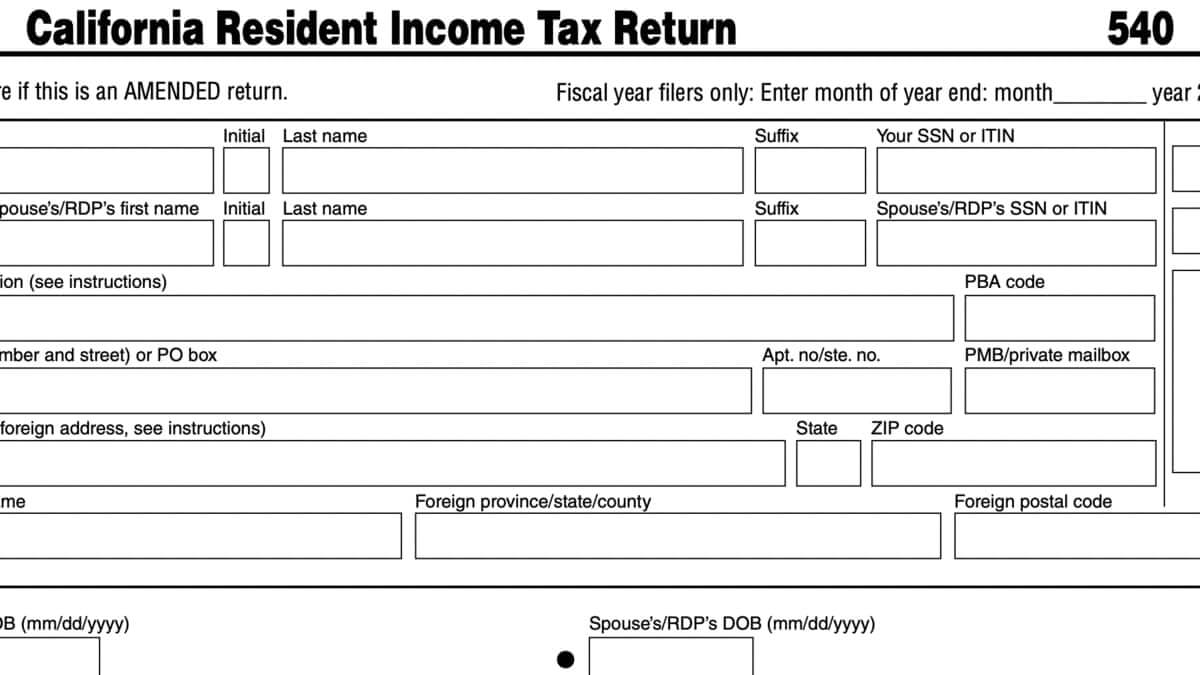

Filing taxes with FTB California is a straightforward process, especially with the agency's user-friendly online tools and resources. Taxpayers can choose to file electronically or submit paper forms, depending on their preference. Electronic filing is often recommended due to its speed and convenience, but both methods are supported by the FTB. Additionally, the agency provides detailed instructions and support to ensure that the filing process goes smoothly.

Read also:Top Kannada Movies Of 2025 Your Ultimate Guide To Mustwatch Cinematic Gems

What Happens If I Miss the FTB California Tax Deadline?

Missing the FTB California tax deadline can result in penalties and interest charges, so it's important to file on time whenever possible. If you're unable to meet the deadline, the FTB offers extensions and payment plans to help taxpayers avoid severe consequences. Understanding the potential consequences of late filings and taking proactive steps to address them can help you avoid unnecessary financial burdens.

Can FTB California Help Resolve Tax Disputes?

Yes, the FTB California offers resources and support for resolving tax disputes, including appeals processes and mediation services. If you disagree with an FTB decision or assessment, you can file an appeal and work with the agency to resolve the issue. The FTB also provides detailed guidance on the appeals process, ensuring that taxpayers have access to the information they need to protect their rights.

What Benefits Are Available Through FTB California?

FTB California offers several benefits and programs to assist taxpayers in meeting their obligations and managing their finances. These include tax credits, payment plans, and other resources designed to ease the burden of tax payments. Some of the most notable benefits include:

- Earned Income Tax Credit (EITC) for low-income individuals

- Payment plans for taxpayers facing financial difficulties

- Waivers and reductions for certain penalties and interest charges

How Can I Access FTB California's Resources?

Accessing FTB California's resources is simple and can be done through the agency's website or by contacting customer service directly. The website provides a wealth of information, including guides, calculators, and filing tools, while customer service representatives are available to answer questions and provide personalized assistance. By leveraging these resources, taxpayers can ensure they're fully informed and prepared for their tax obligations.

Is FTB California the Only Tax Agency in California?

No, while FTB California is the primary tax administration agency, there are other entities responsible for specific types of taxes and fees. For example, the California Department of Tax and Fee Administration (CDTFA) handles sales and use taxes, excise taxes, and other specialized levies. Understanding the roles of these agencies can help taxpayers ensure they're compliant with all relevant regulations.

Conclusion: Navigating FTB California Successfully

The FTB California is a critical agency for anyone living or operating in the state, providing essential services and resources to ensure compliance with tax laws. By understanding its responsibilities, utilizing its resources, and staying informed about deadlines and obligations, taxpayers can navigate the tax landscape with confidence. This guide has provided a comprehensive overview of FTB California's role, responsibilities, and offerings, equipping you with the knowledge and tools you need to succeed.

Table of Contents

- What Is the FTB California?

- Why Is FTB California Important for Taxpayers?

- How Does FTB California Support Businesses?

- What Are the Key Responsibilities of FTB California?

- What Resources Does FTB California Offer?

- How Can I File Taxes with FTB California?

- What Happens If I Miss the FTB California Tax Deadline?

- Can FTB California Help Resolve Tax Disputes?

- What Benefits Are Available Through FTB California?

- How Can I Access FTB California's Resources?