California's tax landscape is governed by a robust authority known as the California State Tax Board, which plays a pivotal role in shaping fiscal policies and tax regulations within the state. As one of the most influential tax bodies in the United States, the California State Tax Board ensures compliance with state tax laws while safeguarding taxpayer rights. Whether you're a business owner, an individual taxpayer, or a financial professional, understanding the nuances of this board is crucial for effective tax planning and compliance.

The California State Tax Board is responsible for enforcing state tax laws, administering various taxes, and providing guidance on complex tax matters. Its jurisdiction covers a wide range of tax types, including sales and use tax, corporate taxes, and personal income taxes. In recent years, the board has taken significant steps to modernize its operations and enhance taxpayer services, making it easier for individuals and businesses to navigate the state's tax system.

As the tax environment continues to evolve, staying informed about the California State Tax Board's policies and procedures is essential. This article delves into the functions, responsibilities, and impact of the California State Tax Board, providing valuable insights for anyone seeking to understand California's tax landscape. Whether you're looking for answers to specific tax questions or aiming to enhance your overall knowledge, this guide will serve as a valuable resource.

Read also:Unveiling The Facts Did Jay Leno Pass Away Unraveling The Truth Behind The Headlines

What Is the Role of the California State Tax Board?

The California State Tax Board serves as the primary authority responsible for enforcing and administering state tax laws. Established to ensure compliance and fairness in taxation, the board oversees a variety of tax programs, including sales and use tax, fuel taxes, and corporate taxes. Its primary mission is to collect revenues efficiently while minimizing the burden on taxpayers. By maintaining transparency and offering educational resources, the board aims to foster trust and cooperation among taxpayers.

- Administers state tax laws and regulations

- Ensures compliance through audits and enforcement actions

- Provides guidance and support to taxpayers

How Does the California State Tax Board Impact Businesses?

For businesses operating in California, the California State Tax Board plays a critical role in shaping fiscal policies and influencing day-to-day operations. The board's regulations and guidelines directly impact how companies calculate and remit taxes, affecting profitability and financial planning. By staying informed about the board's policies, businesses can optimize their tax strategies and avoid potential penalties. Additionally, the board offers resources and tools to help businesses navigate complex tax requirements.

Why Should Individuals Care About the California State Tax Board?

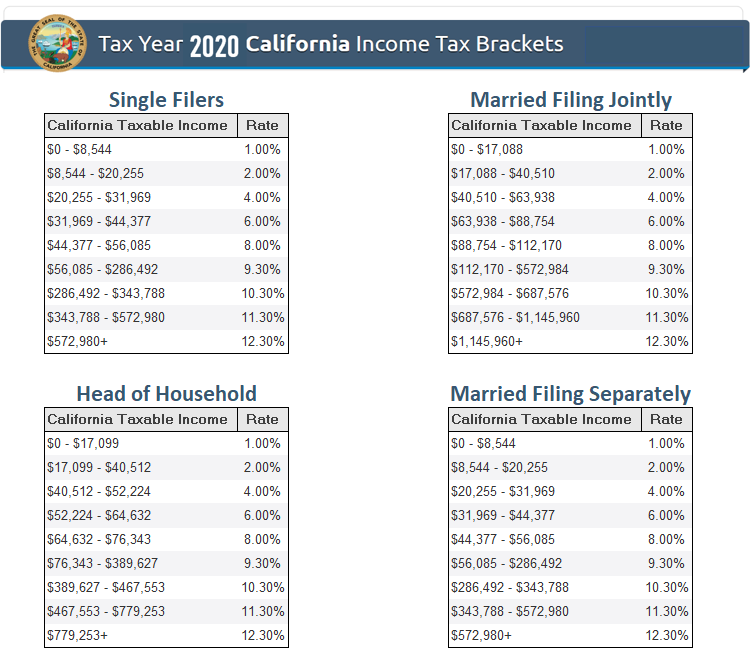

Individual taxpayers in California also have a vested interest in understanding the California State Tax Board's functions and responsibilities. The board's decisions can affect personal income taxes, property taxes, and other levies that impact household budgets. By staying informed, individuals can ensure compliance, take advantage of available deductions, and avoid costly mistakes. The board's website and publications provide valuable resources for taxpayers seeking to understand their obligations.

What Are the Key Functions of the California State Tax Board?

The California State Tax Board performs several key functions to ensure the state's tax system operates efficiently and fairly. These functions include administering tax programs, conducting audits, and providing taxpayer education. The board's efforts are designed to maintain a balance between revenue collection and taxpayer rights, fostering a transparent and equitable tax environment.

How Does the California State Tax Board Handle Compliance Issues?

Compliance is a cornerstone of the California State Tax Board's operations. The board employs a range of tools and strategies to address non-compliance, including audits, penalties, and educational outreach. By emphasizing education and support, the board aims to help taxpayers meet their obligations without resorting to punitive measures. This proactive approach has been effective in reducing non-compliance rates while improving taxpayer satisfaction.

What Are the Penalties for Non-Compliance with California State Tax Board Regulations?

Failure to comply with the California State Tax Board's regulations can result in significant penalties, including fines, interest charges, and legal action. The severity of the penalties depends on the nature of the violation and the taxpayer's history of compliance. To avoid these consequences, it's essential for individuals and businesses to stay informed about the board's requirements and seek professional advice when needed.

Read also:Donald Trumps Blueprint To Wealth Unlocking The Secrets To Financial Success

How Can Taxpayers Stay Updated on California State Tax Board Policies?

Staying informed about the California State Tax Board's policies and updates is crucial for maintaining compliance and optimizing tax strategies. The board offers a variety of resources, including newsletters, webinars, and publications, to help taxpayers stay current. Additionally, taxpayers can subscribe to email alerts and follow the board's social media channels for real-time updates. By leveraging these resources, individuals and businesses can ensure they remain aligned with the latest tax developments.

What Resources Does the California State Tax Board Offer?

The California State Tax Board provides a wealth of resources to assist taxpayers in understanding and complying with state tax laws. These resources include online tools, publications, and educational materials designed to simplify the tax process. By utilizing these resources, taxpayers can gain a deeper understanding of their obligations and take advantage of available deductions and credits. The board's commitment to education and support underscores its dedication to fostering a fair and transparent tax system.

Can the California State Tax Board Help with Tax Disputes?

Yes, the California State Tax Board offers assistance to taxpayers involved in disputes over tax assessments or penalties. Through its appeals process, the board provides a structured framework for resolving disputes fairly and efficiently. Taxpayers can file appeals online or by mail, and the board guarantees a timely response to all submissions. By leveraging this process, taxpayers can address concerns and seek resolutions without undue delay.

How Can Businesses Prepare for California State Tax Board Audits?

Audits conducted by the California State Tax Board can be a source of anxiety for businesses, but proper preparation can alleviate much of the stress. By maintaining accurate records, staying informed about tax laws, and consulting with tax professionals, businesses can ensure they are well-prepared for any audit. The board also provides guidance and resources to help businesses understand the audit process and meet their obligations effectively.

What Is the Future of the California State Tax Board?

Looking ahead, the California State Tax Board is committed to advancing its mission through innovation and collaboration. By embracing new technologies and fostering partnerships with stakeholders, the board aims to enhance its capabilities and improve taxpayer services. As the state's fiscal landscape continues to evolve, the board will play a vital role in shaping policies and ensuring compliance. Staying informed about the board's initiatives and priorities will be essential for all Californians involved in the tax system.

Conclusion

The California State Tax Board is a cornerstone of the state's tax system, providing essential services and guidance to taxpayers across California. By understanding its functions, responsibilities, and impact, individuals and businesses can better navigate the complexities of state taxation. Whether you're seeking answers to specific questions or aiming to enhance your overall knowledge, this guide offers valuable insights into the role and importance of the California State Tax Board. Stay informed, stay compliant, and take advantage of the resources available to make the most of your tax obligations.

Table of Contents

- What Is the Role of the California State Tax Board?

- How Does the California State Tax Board Impact Businesses?

- Why Should Individuals Care About the California State Tax Board?

- What Are the Key Functions of the California State Tax Board?

- How Does the California State Tax Board Handle Compliance Issues?

- What Are the Penalties for Non-Compliance with California State Tax Board Regulations?

- How Can Taxpayers Stay Updated on California State Tax Board Policies?

- What Resources Does the California State Tax Board Offer?

- Can the California State Tax Board Help with Tax Disputes?

- How Can Businesses Prepare for California State Tax Board Audits?